CTE Curriculum

Prepare learners with CTE curriculum aligned to industry standards.

Case Study

The Cost of Financial Literacy

A Dilemma: Americans’ Financial Status

The COVID-19 pandemic exposed many flaws in American society, such as gaping holes in the supply chain and a lack of equitable internet access. Yet perhaps one of the most significant pain points came from the financial instability caused by the economically devastating effects of COVID- 19.

While the pandemic exacerbated many citizens’ financial woes, overall, Americans were not experiencing overwhelming high levels of financial security before COVID-19. A 2019 study by the Financial Health Network found only 29 percent of Americans were fiscally healthy, while 54 percent were only coping financially and 17 percent were economically vulnerable. While many factors can lead to financial instability, a lack of emphasis on financial education and literacy has undoubtedly contributed to American’s monetary concerns.

Despite boasting the world’s largest economy, America ranks 14th in Standard & Poor’s Global Financial Literacy Survey. As reported by Market Watch, there was an eight percent decline in the number of people who could correctly answer basic financial questions, which included topics such as interest rates, inflation, bond prices, financial risks and mortgage rates, from 2009 to 2018. The same study found a decrease in young adults’, ages 18 to 34, ability to correctly answer financial literacy questions. While young adults’ grasp of pecuniary concepts dropped from 30 to 17 percent, adults ages 55 and above remained relatively constant in their financial knowledge, showing only a 3 percent decrease. Individuals who exhibit financial illiteracy are more at risk for ill-advised behaviors, including poor saving and spending habits, overuse of credit cards, imbalanced debt to income ratios and speculative investments.

According to a study conducted by FINRA, 53 percent of Americans are anxious about their financial situation, and 44 percent say discussing their finances is stressful. Young adults feel the burden of monetary instability more acutely, with 63 percent indicating high levels of stress and 55 percent showing increased anxiety due to the state of their finances. Among those who experience financial strain, some common themes emerge. Forbes reported student loan debt hit $1.56 trillion in 2020, and according to NPR, the Federal Reserve Bank determined Americans’ credit card debt surpassed $1 trillion. The NFCC 2019 Consumer Financial Literacy Survey found less than 20 percent of adults are secure in their saving habits. As reported by The New York Times, an analysis from JPMorgan Chase revealed about 66 percent of Americans do not have an emergency fund.

An individual’s fiscal knowledge is not only crucial for their personal finances, but it also has an impact on their professional lives. A survey conducted by the National Financial Educators Council determined five percent of respondents had been turned down for a position due to their lack of financial knowledge. A report from PwC found 47 percent of employees admit monetary stress impacted their productivity at work. Employees who experience high financial stress levels disclosed spending at least three hours a week dealing with personal money problems. According to the International Foundation of Employee Benefit Plans, 80 percent of employers reported personal financial issues impact job performance. As stated by Forbes, American employers lose $500 billion annually due to a loss of productivity from employees’ financial stress.

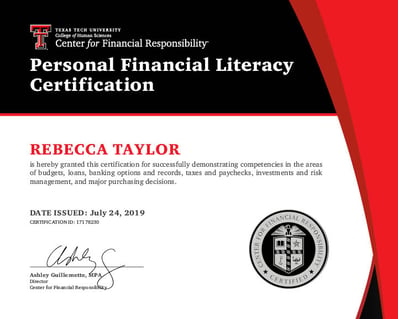

A Solution: Center for Financial Responsibility Personal Financial Literacy Certification

One way to quell the rise of financial illiteracy, limit financial stress and reduce lowered productivity in the workplace is to increase the availability of financial literacy programs. The Center for Financial Responsibility is committed to expanding research and outreach to improve individuals and families’ financial well-being.

The CFR believes teaching financial skills to young people prior to them entering college or the workforce is critical to better equipping them to live independently as adults,” said Ashely Guillemette, Director of the Center for Financial Responsibility. Housed on the Texas Tech University campus, the center hosts many initiatives, including the Center for Financial Responsibility Personal Financial Literacy Certification.

The certification validates knowledge and skills of credit cards, loans, retirement, investments and mortgages. Those who earn the certification are more qualified and prepared to make informed financial choices, perform better in the workplace and achieve long-term financial success, no matter what job they choose. "An individual that has earned the Center for Financial Responsibility Personal Financial Literacy Certification has proven that they are better prepared to meet the financial transitions they're sure to encounter in life,” said Geoffrey E. Brown, CEO of the National Association of Personal Financial Advisors. “In addition, this certification is extremely valuable to employers as it helps connects us to qualified candidates and should be offered at all schools with courses in financial literacy." Individuals across the nation have earned the certification to bolster their financial stability, and in many cases, students earn the certification through their Career & Technical Education (CTE) courses.

A Shining Example: Snyder High School

Snyder High School, located in Snyder, Texas, boasts a robust CTE program featuring 13 different career pathways. “One of our focuses is preparing students for life after Snyder High School,” said Janell Martin, Director of College, Career & Military Readiness at Snyder ISD. “We know that not all students are going to go to college, but all students are going to have a career in some area. So what better way to train them and prepare them while they are going through an educational process with Snyder ISD.”

When their school was closed in March 2020 due to COVID-19, Snyder teachers Lisa Butler and Wendy Hunter decided to implement the Center for Financial Responsibility Personal Financial Literacy Certification in their CTE courses. While they had already planned to implement the certification in their classes, their students’ immediate needs only solidified their decision to make the certification the focal point of their spring curriculum.

“Many families were losing their jobs,” said Butler. “A lot of our students had to pick up the slack.”

Butler and Hunter wanted to ensure their students had a solid background in financial management and an understanding of managing one’s finances related to personal and professional life. “We wanted the students to leave with something valuable,” said Hunter.

One of Hunter’s students, Zairah Cabrera, immediately put the Center for Financial Responsibility Personal Financial Literacy Certification to work after earning it in the spring of 2020. Because she had more free time due to a completely online class schedule and canceled extra-curricular activities, Cabrera decided to get a job at the local Walmart. During her interview, Cabrera was able to show a high level of understanding about the retirement and other long-term financial plans presented by the human resources manager. Her level of knowledge impressed the interview committee, and Cabrera was hired as a stocker.

“I feel like the things she was talking about wasn’t really what I was going to be doing on the job, but gave me a more mature look,” said Cabrera. “It definitely made me more available for the job.”

Despite a busy academic and extra-curricular schedule as a junior at Snyder, Cabrera still holds the stocker position at Walmart. After graduation, Cabrera plans to pursue a career as an elementary educator. She is confident earning the Center for Financial Responsibility Personal Financial Literacy Certification will be an asset to her as she aims toward financial independence and security.

Earning the Center for Financial Responsibility Personal Financial Literacy Certification has set Cabrera on a solid path toward financial stability. Still, not all individuals have the same level of knowledge and confidence. COVID-19 taught Americans many lessons, but perhaps one of the most significant takeaways is the need for greater access to financial literacy training opportunities. An increased emphasis on financial literacy is required as Americans attempt to rebuild their finances and employers search for ways to increase productivity. Opportunities like the Center for Financial Responsibility Personal Financial Literacy Certification are pivotal to creating a society of individuals who have the knowledge and confidence to make smart financial decisions, which impact their personal lives and the economy at large.

SNYDER HIGH SCHOOL

SNYDER, TEXAS

About iCEV

Since 1984, iCEV has specialized in providing quality CTE curriculum and educational resources. iCEV is the most comprehensive online resource for CTE educators and students, offering curriculum for several major subject areas, including agricultural science, trade & industrial education, business & marketing, career exploration, family & consumer science, trade & health science, law enforcement and STEM education. iCEV also acts as a certification testing platform for industry certifications. Recognized companies and organizations utilize iCEV as the testing platform for their certifications. Additionally, iCEV offers Eduthings, a CTE data management platform that simplifies reporting for industry certifications, work-based learning, CTSO participation, and more. For more information, visit www.icevonline.com.