CTE Curriculum

Prepare learners with CTE curriculum aligned to industry standards.

Center for Financial Responsibility Personal Financial Literacy Certification

The Center for Financial Responsibility Personal Financial Literacy Certification verifies individuals possess the ability to successfully navigate vital monetary decisions which affect both their personal and professional lives.

Meeting the Industry Need

The certification assesses industry-valued and industry-recognized standards produced by the Center for Financial Responsibility, a premier institution which works closely with professionals in the field to lead the way in financial education.

The certification validates the knowledge and skills pertaining to credit cards, loans, retirement, investments and mortgages. Those who earn the certification are more qualified and prepared to make informed financial choices, perform better in the workplace and achieve long-term financial success, no matter what job they choose. Additionally, the certification allows employers to identify and connect with more skilled candidates, filling gaps in the labor market and jump-starting individuals’ careers.

Discover job opportunities aligned with the skills acquired through this certification.

The 2018 Purchasing Power Financial Stress Survey found 87 percent of U.S. adults are at least somewhat stressed about money.

“With employees’ financial stress affecting an organization’s bottom line in terms of productivity, higher absenteeism and more healthcare claims, employers today are compelled to pay more attention to their employees’ financial wellbeing.”

- Scott Rosenberg, Purchasing Power President

Related Occupations

- Personal Financial Advisors

- Bookkeeping, Accounting, and Auditing Clerks

Industry Standards

The certification exam consists of 100 questions and assesses knowledge and concepts from the following weighted industry standards:

Budgets

- Money Personality Identification

- Financial Goal Development

- Strategies for Meeting Financial Goals

- SMART Goal Setting Techniques

20%

Investments & Risk Management

- Investment Options

- Saving Techniques

- Investing Risk & Return Relationships

- Retirement & Estate Planning Methods

- Risk Management Strategies

- Insurance Overview

15%

Loans

- Sources & Types of Credit

- Credit Reports & Scores

- Borrowing Processes

- Education & Training Costs

20%

Banking Options & Records

- Types of Financial Service Providers

- Products & Services Offered by Financial Institutions

- Types of Banking Accounts

- Financial Record Maintenance

- Financial Statement Interpretation

10%

Taxes & Paychecks

- Tax Types

- Tax Liabilities & Related Forms

- Tax Returns

- Tax Breaks, Deductions, Credits & Exemptions

- Employee Compensation & Benefits

20%

Major Purchasing Decisions

- Home-Buying Process

- Amortization/Mortgage Payment Structure

- Types of Mortgages

- Car-Buying Process

- Incorporating a Major Purchase into a Budget

15%

Ensure Learner Success

Our comprehensive, optional prep materials for iCEV-hosted certifications ensures your learners master the material and earn their credentials.

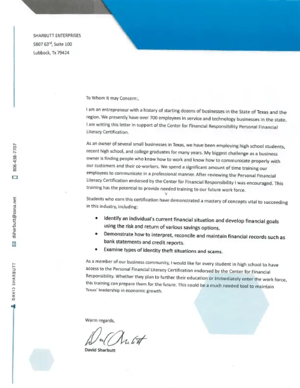

Featured Support Letters

View letters from businesses and organizations expressing their support of the certification.

About the Center for Financial Responsibility

The Center for Financial Responsibility is committed to enhancing the financial wellbeing of both individuals and families. The Center advances these causes by supporting multiple initiatives such as backing research surrounding important policy issues in the financial planning industry and hosting outreach programs to promote future financial success.

"The CFR believes teaching financial skills to young people prior to them entering college or the workforce is critical to better equip them to live independently as adults. By partnering with iCEV, we are able to expand our educational outreach to enhance the overall financial stability of students nationwide."

Sarah Asebedo, Ph.D., CFP®

School Director | Associate Professor

Center for Financial Responsibility

3 Simple Steps to Get Started Today

See how iCEV can help you get back to what matters most – student success.

Start Your Free Trial 🚀

Activate your free account to access our full suite of CTE educational materials.

Schedule a Demo 📅

Dive right in with an iCEV team member to explore our solutions.

Request a Quote 📝

Find what’s best for your district and discuss how we can fit your budget.